Glyphosate price bottoms out

Lets talk about glyphosate and paraquat first as dessication and summer spraying are fast approaching.

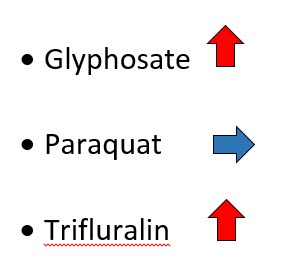

The dominant driver of glyphosate currently remains oversupply but we are seeing signs of major factories getting on top of their stocks and starting to lift prices ever so slightly. After hitting lows about 12 weeks ago, price increases to glyphosate technical have added around AUD0.05/L. Its probably a sign the market has found its bottom. Cropsmart has been able to provide an opportunity for its customers to lock in product at the bottom of the market and many of our customers have taken up the opportunity.

Paraquat is a similar story, prices have drifted lower over the past 6 months and indications now are that the market is close to nearing a bottom. You should have no fear purchasing paraquat at current prices for use over the rest of this calendar year. The price is currently 25% below the same time last year.

Given the situation for both these products the single biggest driver of our decision making is the exchange rate. With most forecasts of the dollar going lower, increasing the aud cost of these chemicals, the sooner you lock in chemical over the next 6 months the better. We believe the combination of markets close to the bottom and the potential for exchange rate driven price rises make this decision an easy one.

Finally some vision into the trifluralin market. Its still a long way to the start of the 2016 season but most of the raw materials for sowing chemical are starting to be purchased. The currency has added 30% to the price of chemical since this time last year. Additionally trifluralin technical has firmed in price. A key factory has still not committed to producing, leaving only 3 factories to supply and they have been able to ration supply, supporting the price. Consequently at this stage retail prices of trifluralin look like being above $6/l this year. Once again our concern is around the currency. We think the risk is tilted to further price rises rather than falls.

For any further advice around timing your purchases make sure you call your local sales rep. They stay on top of the latest market information and will be able to provide you advice that will save you money.