Market Update November 2023

Harvest is well underway for most of you and people keep asking how the rest of the country is going. A quick update for you from the West to the East of our network. SA Lower Rainfalls – hit and miss, some guys are reaping average and others well below average, it was luck of the draw with the thunderstorm events that came through this year. Most growers are reaping average if they missed the frosts but getting a thunderstorm come through in the back half of the season is making a big difference. The higher rainfall areas of SA & VIC are only just started but yielding average to above average with some more reliable rainfall at key times of the year. The VIC Mallee are having a great year with above average yields early so it’s great to see a few winners this year. The VIC Wimmera is yet to start so we’ll give you a good update next month.

Chemicals

The overall trajectory is positive for your chemical budget for 2024 in that most overseas suppliers have spent Covid building up their production capacity so are now fully stocked and keen to write business. Shipping rates have hit a bottom and bounced but still at pre-Covid affordable levels. For sowing next year, we should see pricing return to pre-covid levels across the board which is great news for Australian growers. Keep in touch with your local Crop Smart reps for any good early deals that will come up due to overseas suppliers being keen to move stock out of season.

The big two of Glyphosate and Paraquat have plateaued since last month and most Australian resellers have purchased at current overseas pricing so that will set the market for the first half of summer. We have the same opinion as last month here – buy what you need but no need to fill your sheds up for now. As always we will keep you updated if this changes.

There’s two other factors that will influence input pricing – The Australian Dollar and the Middle East conflict/Oil Price.

The Australian dollar has seen some fluctuation lately and we know you’re following it closely as it has an impact on grain exports. A further weakening of the dollar will increase chemical pricing as almost everything is purchased in US dollars. See the chart below for the drop since July this year.

Australian to US Dollar Nov 2022 – Nov 2023

Energy & The Middle East

Oil prices continued their decline following a larger-than-anticipated weekly increase in U.S. crude inventories. Additionally, concerns about reduced demand in China contributed to the downward pressure on crude prices.

Further influencing the decline was information revealing that Chinese refineries processed lower amounts of oil in October compared to the previous month. Although other indicators suggested some economic resilience in the largest oil-importing nation, with industrial production exceeding expectations, the losses on Wednesday largely negated gains from earlier in the week. Market sentiment remained cautious about demand despite positive forecasts from the International Energy Agency and the Organization of Petroleum Exporting Countries.

Concerns over crude demand deepened as weak GDP figures emerged from Japan and the euro zone, reflecting worsening economic conditions globally.

Brent oil futures dropped 0.5% to $80.11 per barrel, while West Texas Intermediate crude futures fell 0.7% to $76.11 per barrel by 20:41 ET (01:41 GMT). Both contracts were on track for a 1% decline for the week, marking their fourth consecutive week of losses.

Over the past three weeks, oil prices had experienced a significant decline as traders adjusted for a lower risk premium related to the Israel-Hamas conflict, coupled with a series of discouraging economic reports from China that raised concerns about demand.. We saw during Covid the impacts of a high oil price impacting many agricultural inputs, especially granular fertiliser. There are also many agricultural chemicals made with solvent as a base including Trifluralin, Triallate and Prosulfocarb that are impacted.

Crude Oil WTI Futures – Previous YTD

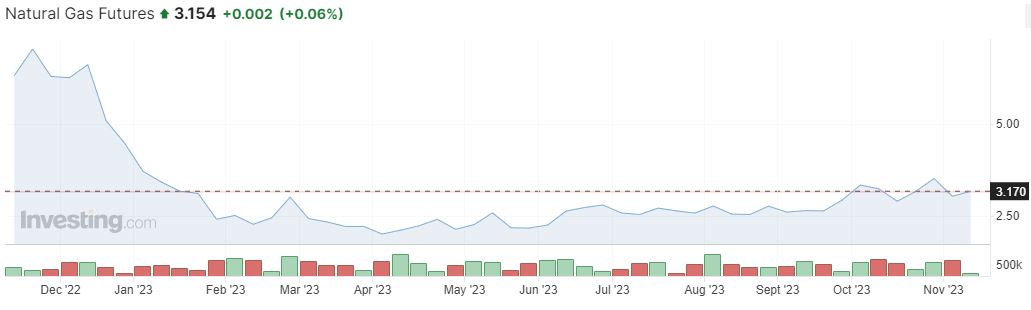

U.S. natural gas futures experienced a significant drop of about 7% on Monday 6th November. This decline was attributed to record-high gas production and forecasts predicting mild weather continuing through late November. The mild weather outlook is expected to keep heating demand low, allowing utilities to continue storing gas for a few more weeks. Gas is critical for fertiliser manufacturing so further declines will be welcomed especially for Urea.

Natural Gas Futures – Previous YTD

Fertiliser

China’s main economic planning body, the NDRC, halted inspections for MAP and DAP exports on November 9th, and this will continue until further notice due to a recent increase in domestic prices. Instead of focusing on exports, Chinese suppliers will be forced to sell into the domestic market as they build inventory for their winter storage. This increased demand had pushed prices up in the last two weeks which could have been the reason for decision.

The market seems to have formed different opinions about the government’s inspection ban. Some think it won’t make a big difference right away because there wasn’t much available for export anyway. Others aren’t sure if stopping inspections will completely stop products from leaving China with some tonnage still being exported. However, we are aware of at least one supplier withdrawing offers for MAP destined for Brazil & Australia in December.

In the United States, there have been changes in import tariffs for phosphates. Import duties on phosphate from Russia have increased from 9% to 28.5%, while tariffs on Moroccan-produced phosphate have decreased from 19.97% to 2.12%. The US has faced supply issues and higher prices compared to other major markets, like Brazil which would appears to have forced The US Department of Commerce’s hand. OCP, Morocco’s state-owned producer used to supply over half of the MAP and DAP imported to the US. The US may need to increase imports to replenish their low inventories, similar to Australia. India, Pakistan, and Brazil are also active in the market.

The constrained volume from China coincides with global producers having steady allocations and orders for November and December. As mentioned in earlier updates, major importer inventories are low. This trend extends to Australia, where limited inventory and a substantial import program for Phosphates now require sourcing from greater distances and a restricted number of producers.

Whilst the Chinese government can reverse this decision to halt inspections as quickly as they made it all, suppliers are genuinely concerned and have withdrawn prices this week. The Australian East Coast may need to replace 400K tonnes of Phosphates traditionally sourced from China. Whilst those tonnes are available, they come at extra freight costs and no doubt higher cost of goods on the back of the inspection ban. The other key consideration is the other sources such as the Arab Gulf and North Africa have significantly longer lead/voyage times.

The global urea market is currently slow, with weak sales. The recent Indian IPL tender hasn’t sparked significant demand in other markets like Europe and Brazil. Some inquiries have come from Latin America, Turkey, and Europe, but the volumes sought are not large. The market is closely monitoring developments in China, where producers are showing a greater willingness to commit granular urea to long-haul markets. Unlike Phosphates Urea markets are definitely softening which is good news for now (it can and will no doubt change very quickly).

The best advice is to keep your head on a swivel and talk to us about your requirements, your sales rep will always have the most current information and will be able to keep you updated.

We hope you have a safe run during harvest. It’s a time when accidents happen so please take the extra time to be safe for you and your staff. We hope you have a smooth run and enjoy an earlier than normal finish before Christmas. As always, we will keep you up to date if anything in the market changes and keep you planned towards 2024.