May Market Update

Great to see most of you have got your cropping program in and whilst there was some good early rain pre-sowing everyone is now looking for a good drink to give the crops a good start. Most areas are starting to dry up on top so hopefully the next 20mm of rain is “just around the corner”… if you haven’t already got it in the past 24 hours!

Across our network plantings would be a little down on last year with a few marginal growers dropping a small amount of their cereal program off and a few medium rainfall clients dropping a bit of canola out late. Overall things are positive and many of you are telling us you’re looking for a break post-sowing, especially those that had a late harvest. Please make sure you give yourselves a break and freshen up – even if it’s only a quick trip off the farm!

Post-Emergent Chemicals

Many of you have already organised and ordered for post-emergent product and we are currently seeing good supplies of most products. As we work into the post-COVID world we’re seeing some normality resume to shipping which is a positive for supply. With shipping now back to 2020 timings, companies can bring product in quicker and if anyone runs out before the season starts they now have time to get more in for the back end of the season. This is a positive for supply in general across the Australian ag chem market. The recent change in the EU ruling of Haloxyfop MRL’s on canola means there’s a rapid swing to Quizalafop as a replacement. If you haven’t ordered this one yet we’d recommend you do get onto it as supply in the country will be stretched.

Glyphosate

As is the case across the board we’re seeing chemical prices come back from their COVID highs. The reason for this is simply supply and demand. Our overseas suppliers have been able to sell at high prices in the last two years and have built up a good supply of stock, and in some cases even increased production capacity. The demand for products is low globally, and domestically many farmers and resellers have had high stock levels coping with the recent domestic demand. As this demand has now dropped the overseas suppliers are having to drop their prices to move their stock. This is great news for Australian farmers as prices are coming back across the board with some actives dropping quickly (see below chart).

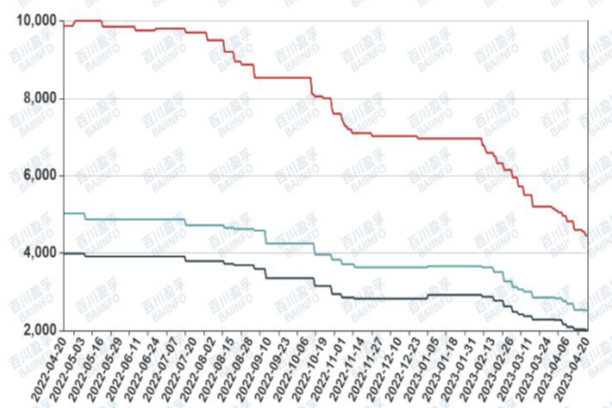

Glyphosate Pricing: April 2022 – April 2023

Time (months)

Glyphosate 450 was $3.60L pre-Covid lockdowns and then spiked to over $12L. It continues to come back and in 6 weeks’ time will be selling back in the $4L’s. Later in the year we might be back to pre-covid prices, which may mean a great opportunity to reload the empty sheds around the country. We are monitoring this one daily and will be in touch when we think it’s a good time to buy.

Paraquat

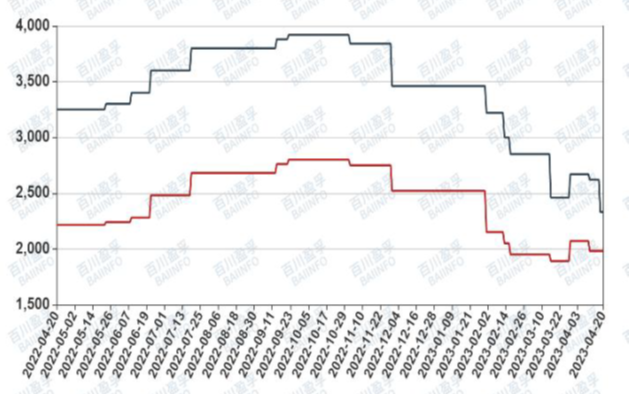

It’s a similar story but prices did hold strong at the start of this year, but we are seeing it softening again, see the chart below. Paraquat 250 was $3.50L pre-covid, lifted to $7L and whilst the market is $5L domestically today we could see that drop back to being in the $4s from July onwards. This product has been in high demand with the amount of double knocking happening this season and is doing a great job reducing glyphosate resistant weeds across the network. Hopefully we will see this practice becoming more affordable going forward.

Paraquat Pricing: April 2022 – April 2023

Time (months)

Mice

Given the good harvest last year we’re starting to see mice pressure across the network. Please be proactive with ordering mouse bait as it’s a product no company likes to stock a large supply of due to the irregular sales year after year. Please note if you’re wanting to purchase and use 50g/kg product you’ll need to complete the online Mouse Bait Stewardship course and associated reporting to show to our store staff before purchasing. For more details on this please read here https://www.grainproducers.com.au/mouse-bait-stewardship. Note there are no requirements for course completion or reporting for the 25g/kg product in the market.

Fertiliser

As the sowing season comes to an end feel free to contact us for any top-ups you may require. All the major terminal collections have slowed down from the chaos in April. Phosphate supply out of Geelong is OK but other southern ports are getting very tight.

Nitrogen

Both local & international markets remain very quiet. Internationally the market is focussed on the next Indian tender, monitoring China for Urea exports and the decreasing gas price (see below). International markets are generally quiet through the next few months and with dry conditions in Australia our view remains to hold purchasing short-term.

Natural Gas Futures Pricing Overview (July 2019-July 2023)

Time (months)

We hope that an inch of rain is not far away, and your crops can spring out of the ground to make a great start to the season. As we draw close to the end of the financial year, I’d like to point out our Smart Prepayment product that is extremely popular with our growers. If you’re looking to minimize your tax, please discuss this with your accountant. It offers great flexibility if you’re unsure of what you need to purchase and put in the shed. https://www.cropsmart.com.au/about-us/smartfarmer/

If any of the team can help you with your inputs, please give us a call.